Приобрети журнал - получи консультацию экспертов

№4(15)(2013)

The fall in economic growth for Q1 2013, high level of real interest rates during the period and, consequently, cost of raising funds, rising deficits and discussions on need to increase IMF borrowing, causing new approaches to monetary policy and its interaction with fiscal instruments and new incentives to increase domestic demand and production. A chief economist from international investment company, PhD in economic science, Sergey Kulpinskiy talks about possibility to introduce new incentives in monetary policy, which can be solution for the economy of Ukraine.

State Budget of Ukraine for 2013 was calculated based on the following macroeconomic indicators: nominal GDP – 1,576 trillion UAH, GDP growth rates - 3.4%, inflation (December to December) - 4.8%. However, experts from international financial institutions publish much more pessimistic forecasts. In particular, the IMF recently announced that GDP growth in Ukraine in 2013 will be equal to zero indicator. The World Bank also revised the GDP forecast downwards - this year up to 1%. While experts from WB believe that in 2014 an improvement in foreign markets is possible, bringing Ukraine's GDP growth in 2014 is expected to reach 3%. In 2015 they forecast a GDP growth of 4%.

Experience from policy of several countries on massive infusion of money supply in economy has demonstrated, on the one hand, its effectiveness in reducing interest rates, lowering cost of debt and revival of financial markets. On the other hand, with significant growth of public debt, GDP did not show significant increase, and banking system showed no increase in either assets or loans expansion. It can be noted that the channels of transmission influence mechanism of monetary policy on economic growth in any country are not perfect, but they need to take into account positive aspects at present conditions of rapid decline in demand.

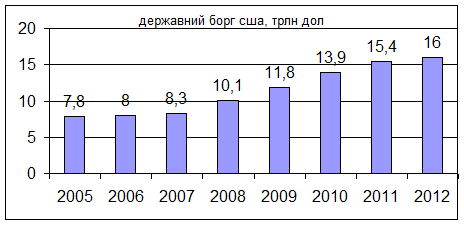

If you look at policy of the National Bank of Ukraine, it is generally held belief that it is pretty strict. After all, growth in monetary supply in recent years has been insignificant and lower than nominal GDP growth, which resulted in lowering monetization. Thus, annual nominal GDP in 2009 rose from 940 billion UAH to 1.4 trillion UAH, which is 450 billion UAH, while monetary supply during this period showed growth of 500 billion UAH up to 875 billion UAH, which is 375 billion UAH. In comparison, U.S. GDP grew from $14.08 trillion to $15.1 trillion in the years since crisis of 2008, that is $1 trillion, while growth of monetary supply was more than $3 trillion over the same period. The same applies to a number of other developed countries, where growth rate of monetary supply were much higher than growth rate of nominal GDP. One consequence of this monetary expansion was increasing debt, despite the fact that number of sectors remained without significant investment.

From beginning of this year, you can see some easing of monetary policy of the NBU. In particular, the first three months of year it bought internal government bonds in its portfolio for over 20 billion UAH, which actually corresponds to the amount in 2012, and growth of money in economy was 26 billion UAH, which is almost ten times the amount of growth over the same period last year. As a consequence, lending to real sector also moved out of place, unlike last year's stagnation, and growth of new loans during this period made 11 billion UAH. This somewhat indicates compliance with policy of "quantitative easing" aimed at flooding economy with money, increasing aggregate demand and stimulating production.

But yet it is so far in advance to talk about economic recovery. Therefore, we consider which effects had monetary expansion in some countries. Of course, printing money rapidly since crisis in most countries did not produce a significant effect, however, interest rates have fallen. Thus, cost of mortgages in the U.S. fell to 5.3%, although before crisis it was more than 5%. Thus credit conditions tightened. Before crisis, cost of the 10-year Treasury bonds of U.S. government accounted for about 4%, now – for almost 2%, in part - through their purchase by the federal system in its portfolio.

Volumes of new granted loans have declined. Thus, total mortgage portfolio of U.S. banks over the past five years declined from $13.1 trillion to $12.9 trillion. Government debt thus increased by almost $8 trillion. However, unemployment, which at the peak of crisis, in late 2009, was 9.9%, came down to 7.7% as of February 2013. That is significant money printing in the U.S., which at the same time accompanied by significant accumulation of public debt, was also a significant fiscal stimulus. The latter helped supporting employment, although added very little GDP.

In another country that does not have reserve currency - China - fiscal stimulus in 2009 as a significant investment expenses also supported economic growth and led to increase in domestic consumption under fall of exports. Monetary expansion was so great that a number of foreign investors and rating agencies expressed concern about possible "overheating" of banking sector in the country due to high volume of potential problematic loans. This is despite the fact that China's economy and monetary supply growth ensured currency revenues from exports and accumulation of foreign reserves from $1.8 trillion to $3.2 trillion.

What is the solution for the economy of Ukraine, where there is neither reserve currency, nor significant export revenues, or its diversification? Rapid increase in monetary supply through "quantitative easing" without appropriate action is unlikely to lead to investment recovery. Rather, it again will increase inflation risks and amount of dubious investments from both the banks and the state. To avoid this, it is necessary to introduce a range of measures. These include, in particular, appropriate easing in monetary policy which must be accompanied by softening of fiscal policy, i.e. additional budget expenditures to increase investment in economy. This public-private partnership should be implemented in equal proportions from foreign investors who meet predetermined criteria that will avoid corruption schemes and previously unprofitable projects will boost productivity and employment in economy.

It would also create a number of new tools to absorb potentially inflationary dangerous issues under sovereign investment projects or recapitalizing troubled institutions. This includes conversion of debt obligations issued under the state guarantees for investment projects in shares for their investors. We need more prudent debt policy aimed at reducing risks of sharp increase in its value. This is rebalancing of internal government bonds at NBU portfolio, creating a more liquid market for internal government bonds in foreign currency to the public.

Головне